strategy-risk

How I Learnt to Stop Worrying and Love the Risk

Published: December 8, 2014

Read Time: 5 minutes

Fact: ‘My name is Trent and I take risks.’

While this may sound like a paradoxical statement given the inherent conservatism of my chosen profession I still, however, assert that this personal disclosure holds true.

Fact: ‘I was not always this way.’

In my earlier years I often procrastinated when making a decision, either personally or professionally. At times this was born of irrational fear but, more often than not, it reflected a need for greater control over my life.

What happens if I say this or do that? Will there be more negative outcomes than positive? How will I deal with any unwanted consequences? This inner dialogue could continue for days or weeks depending on the perceived importance of a decision before me. As a result, I often took no action in order to avoid the risk completely. In the past I would have described myself as being risk averse.

Yet, even with my risk averse tendencies I found that some of the ‘safer’ decisions I took turned out to be unmitigated disasters. Then there were times when I nervously threw caution to the wind only to find that my ambitious gamble paid off, albeit with chest pains and some minor gastric ulceration.

Through these experiences I learnt one of life’s great lessons: despite our best efforts to determine all the ‘known knowns’, and even the ‘known unknowns’, we can never foresee all the ‘unknown unknowns’. This revelation was a game changer for me.

It highlighted to me that whilst risk is inherent in almost everything we do, we must still take risks in order to achieve our goals.

Beyond this personal insight I formed the view that most organisations are essentially led by three styles of leadership.

The first type of leader is the risk averse. They can always find a multitude of reasons not to take an action that creates risk for the organisation or themselves. They often befriend the risk manager to garner support for saying ‘no’ or avoiding a decision that they might be held accountable for. They want high levels of controls and bureaucracy so thick you can’t sneeze without having it approved in triplicate for fear that a flu pandemic may wipe out the organisation. For them the potential for loss is always greater than any rewards that they might ever hope to gain. Think of the insurance salesman played by Ben Stiller in the movie Along Came Polly.

The second type of leader is the optimistic gambler. They have their eyes firmly fixed on a desired outcome and need to achieve it at any cost. Naysayers and panic merchants have no place in their world and this can include risk managers. For them it is all about the end result and they won’t be slowed down by risk analysis and the implementation of controls. They are prepared to take a chance because the desired reward is worth more to them than any loss they may experience. Think of the professional stuntman Johnny Knoxville in any of the Jackass movies.

The third type of leader is the innovator. They are a blend of the optimistic gambler and the risk averse. They are pragmatic enough to consider the known risks and implement any required controls, yet remain steadfast in the achievement of future innovation and growth. Their concept of risk reward is similar to that of the optimistic gambler however their appreciation of risk management reflects that of the risk averse leader. Think of the suave heist mastermind played by George Clooney in the movie Ocean’s 11.

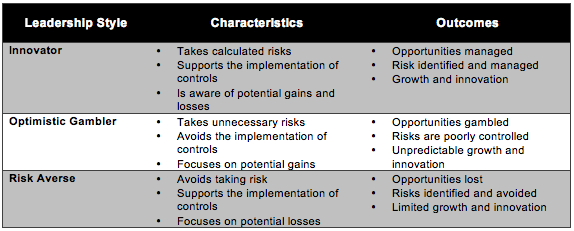

The following table lists the characteristics and outcomes for each leadership style.

You might argue that these three types are extreme and somewhat polarised. Nonetheless I challenge you to consider which leadership type you most relate to: the risk averse, the optimistic gambler, or the innovator? Or do you alternate between all three types depending on the circumstances?

So how can these three different leadership styles impact your organisation?

I support the view that risk management is ultimately about trying to balance risk with rewards. Further, I believe that for an organisation to be innovative and competitive whilst remaining in control there are two elements necessary to achieve effective risk management: an integrated and well communicated risk management framework, and the presence of informed leaders who can take calculated risks.

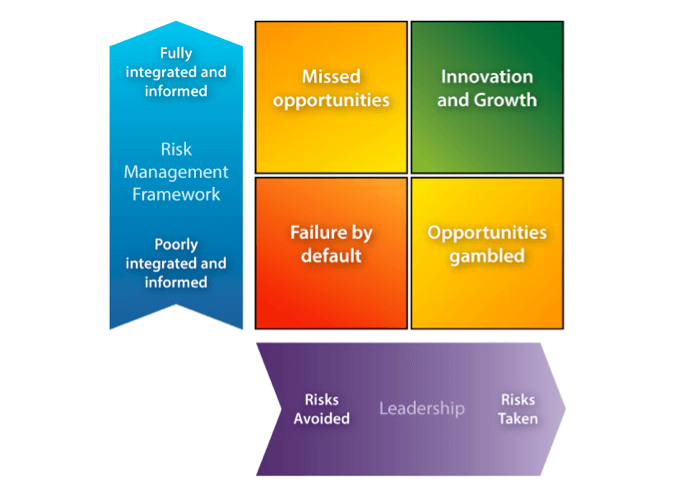

The following diagram illustrates the relationship between these two elements.

If an organisation has an integrated risk framework and implements high levels of control, but its leaders avoid taking on any risks in order to achieve their objectives, there is a chance they will miss out on opportunities.

Alternatively, if an organisation fails to integrate its risk management functions and its leaders gamble with its opportunities then they risk losing it all.

However, where an organisation has an integrated risk management framework, and its leaders are prepared to take calculated risks whilst still implementing effective controls, then they will manage their risk more effectively and position themselves for greater success.

In summary, good risk management is achieved when its important principles are embedded throughout an organisation, and its leaders are prepared to consider its impacts when taking risks in order to achieve innovation and growth.

This article was originally published in the 2013 Better Boards Conference Magazine.

Share this Article

Recommended Reading

Recommended Viewing

Author

-

Director – Assurance Services

- About

-

Trent has a broad background in risk management, quality improvement, and assurance in both the not-for-profit and commercial sectors. In addition to working for complex organisations such as Mater Health Services and QGC – BG Group, he also has held office within the Queensland Chapter of the Risk Management Institute of Australasia. Trent is presently Director – Assurance Services, for Churches of Christ in Queensland, which provides aged care, family and community care, early childhood and child protection services across Queensland, New South Wales and Victoria

Found this article useful or informative?

Join 5,000+ not-for-profit & for-purpose directors receiving the latest insights on governance and leadership.

Receive a free e-book on improving your board decisions when you subscribe.

Unsubscribe anytime. We care about your privacy - read our Privacy Policy .