finance

The True Cost of Business

Published: June 9, 2014

Read Time: 3 minutes

We commonly relate cost of doing business with the monetary cost of inputs to deliver an output. However, true or full cost and costing involves detailed identification, categorisation, measurement and valuation of ALL resource inputs required to achieve the objectives of the activity, program and ultimately, the purpose of an organisation.

As part of good organisational governance, it is the Board’s role to establish the framework, methodology and approved policies under which service costing (and eventually pricing) is managed.

Further to this, both the board and management team must work together to understand the magnitude and behavior of all costs to effectively prepare budgets, assessing impacts and benefits of planned changes in service delivery, and report against financial accountability.

Only then will an organisation be ready to start calculating the Unit Costs of service, activities and outputs for program stakeholders – from government departments through to individual clients and their families.

And so the spreadsheet grows…

Some resource inputs are relatively easy to identify, value and allocate against individual programs, activities and clients. For example, the annual cost of rent can be amortized into quarterly, monthly or weekly costs, and allocated according to an agreed percentage ratio. Operational costs such as direct service costs and annual administration costs (overheads) that are captured in our profit and loss statements are already identified and valued, it just comes down to policy decisions on how they are allocated.

Other resources are more challenging. Capital costs, such as buildings, large equipment and infrastructure, vehicles etc., are allocated over multiple periods. Some capital purchases can appreciate in value, and some depreciate. So how do we allocate current costs for the use of an office building that was purchased 10 years ago as a property investment from accumulated members’ funds?

In these cases, a valuation of the potential cost is required. Best governance practice would therefore require a policy decision as to the assumptions as bases of valuing the periodic full cost of this resource input.

But Wait! There’s More!

What if a benefactor donated the building? And what if volunteers delivered the activity?

Costs that are not reflected in the exchange of money, but are still an essential contribution of resources are Shadow or Imputed costs and should be recognised in the calculation of true costs.

Try this exercise to get you started.

Select a regular, everyday activity or service program of your organisation:

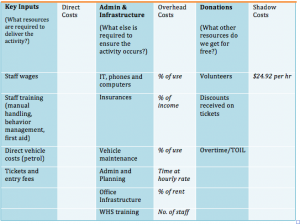

- List all of the Key Inputs, Administration and Donations associated with this activity (a few examples have been listed below to get you started).

- Decide on an approved method for apportioning the overhead costs to this activity (percentage of use or percentage of income is most common).

- Allocate direct costs to key inputs.

- Apportion a percentage of overhead costs.

- Place a value on the donations to calculate shadow costs.

While this is quite a simplistic way of looking at costs, this exercise does help raise discussions on how overhead costs should be apportioned, and the common shadow costs to consider. Once comfortable with this methodology, we are ready to move onto more formal Unit Costing Tools. National Disability Services (through ADHC) and Queensland Council Of Social Services both offer excellent costing tools, free to not-for-profit organisations.

For a free copy of CSA’s Costing, Pricing and Budgeting Workbook, please email Linda Hayes at [email protected].

This article follows up Linda Hayes’ earlier article A Story of a Horse and Cart on assessing organisational sustainability.

Share this Article

Recommended Reading

Recommended Viewing

Author

-

Managing Director

- About

-

Linda Hayes is Managing Director – Strategy at Corporate Synergies Australia. With over 20 years’ experience in business development, strategy and marketing, Linda has worked across a vast range of industry sectors to assist organisations to deliver business growth and sustainability through tactical solutions and strategies. Linda has worked with over one hundred not-for-profit organisations throughout Australia, as well as a range of private sector service organisations with significant government funding. Linda has extensive local and state government experience including governance and risk projects for NSW government agencies. CSA is currently a panelled service supplier to the NSW Government – Office of Communities (Aboriginal Affairs) for administration management, a preferred trainer for National Disability Services (Qld), and regular contributor to Better Boards.

Found this article useful or informative?

Join 5,000+ not-for-profit & for-purpose directors receiving the latest insights on governance and leadership.

Receive a free e-book on improving your board decisions when you subscribe.

Unsubscribe anytime. We care about your privacy - read our Privacy Policy .