governance

Customer-Centric Governance… Customer is King, Cashflow is Queen

Published: January 15, 2018

Read Time: 5 minutes

In a challenging, competitive customer-driven environment Customer-Centric Governance is critical for boards to adopt to ensure their organisation keeps on winning in the future.

The need to balance and integrate ‘heads and hearts’ with ‘business and service’ is becoming increasingly more challenging, yet more compelling for directors, chief executive officers and executives (leadership teams) of community businesses (NFPs).

Integrating and balancing an organisation’s business objectives and outcomes in the new customer-driven, competitive marketplace with existing or future service objectives and outcomes is a tough call, particularly given that many leadership teams remain oriented to the government-funded welfare mentality and approach.

Today many leadership teams are being seriously challenged as they try to simultaneously deliver on their vision and mission, the strategic transformation of their organisation, the re-engineering of their business model and reinvention of their culture.

In the new customer-driven, competitive marketplace, leadership teams must be prepared to truly recognise this dilemma and address strategic challenges and opportunities from both governance and organisational perspectives.

Against this backdrop two governance imperatives have emerged for leadership teams:

- Customer-centric governance; and

- Cashflow-centric governance.

Customer-centric Governance

Customer-centric governance is the board’s most vital focus and undertaking in the new customer-driven, competitive marketplace.

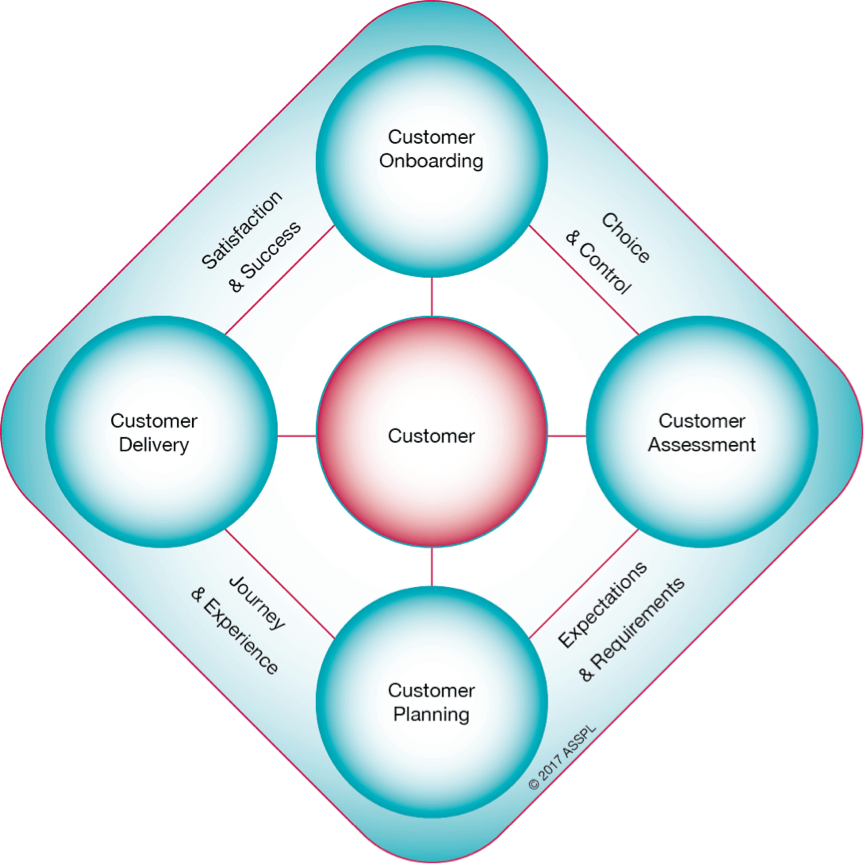

The four key principles that create a framework for customer-centric governance are:

- Customers’ choice and control;

- Customers’ requirements and expectations;

- Customers’ journey and experience; and

- Customers’ satisfaction and success.

From a governance perspective, appropriate documentation and practical application of relevant governance policies and procedures should be aligned to these four customer principles. Policies and procedures should include board and customer relationships, the board’s duty of skill and care, duty of disclosure and transparency, risk management and, where applicable, clinical governance.

Consequently, boards may wish to consider the following two-step approach:

- Firstly, work with chief executives and executives to ensure they have co-designed and documented their own unique, customer framework and principles, possibly in the form of a model and associated descriptors.

- Secondly, ensure their governance system contains governance policies and procedures that address requirements of the Corporations Act 2001 (Cth), as well as other relevant Local, State or Commonwealth government Acts.

Cashflow-centric Governance

In the new customer-driven, competitive marketplace an increasing number of leadership teams are coming to recognise the pragmatic reality that “Customer is King, Cashflow is Queen”.

As this old adage conveys, when it comes to cashflow-centric governance, boards must go way beyond just having an annual budget… the organisation’s new business model must be aligned to a robust financial model. In turn, the financial model provides the basis of projected cashflow, profit and loss and balance sheet statements, which are measured against the key drivers and metrics of the business.

However, it is once again imperative that boards ensure their governance systems also contains governance policies, procedures and tools addressing requirements such as the duty of solvency, fiduciary duties, monitoring and review.

Customers, Who Are They Really?

Customers, you say… they are our clients, residents, participants, patients or other similar technical service titles.

But, has your leadership team seriously researched and analysed the following three customer considerations?

1. What are their various customer categories? What markets and sub-markets do they emanate from? What are the various market channels that direct them to your organisation, e.g. Business to Business (B2B), Business to Customer (B2C) or Business to Government (B2G)?

These categories may account for customer, market and market channel characteristics, behaviours and trends, and therefore provide unique strategic, organisational and/or individual insights and business intelligence that can assist in the development of specific customer, market or market channel strategies and projects.

2. What value and benefits do customers bring other than the evident service requirements, funding and outcomes/outputs?

The unique, additional value and benefits provided by customers should not be under-estimated. These beneficial behaviours may include:

- Driving repeat business, increasing utilisation of your services and income for your organisation;

- Creating referral business, referring friends, family, colleagues and even new acquaintances, a cost-free growth of your business;

- Engaging as board ambassadors, who proactively advocate or promote your business, strengthening its brand and image, once again at no cost or effort to your organisation; and

- Becoming workers in your business, whilst remaining a customer, they volunteer and/or become a contributor, such as a donor or sponsor.

3. What additional engagements and contributions, over and above additional sales, can your organisation provide to these customers in return?

Customer loyalty programs are common but often in reality provide very little tangible value or benefit. Simple acknowledgement in the form of a communication, a meeting, or an invitation to a special event can be incredibly powerful mechanisms that not only genuinely recognise individual customers, but actually re-enforce the four previously mentioned categories of behaviours.

Conclusion

As the intensity of customer choice and control increases and the dynamics of a competitive marketplace pan out, dramatically reshaping your industry/sector, your board may wish to consider not only the realities and practicalities of the new environment but how organisations are or will be operating.

Ideally this will mean co-designing, developing and delivering customised or individualised services or products within an agreed timeframe, at a defined price and to a pre-determined standard.

In essence, the vast majority of community businesses are becoming professional service organisations.

Consequently, as “Customer is King, Cashflow is Queen”, a board must not fail to adopt a pragmatic approach to customer-centric governance and cashflow-centric governance.

Share this Article

Recommended Reading

Recommended Viewing

Author

-

Principal Consultant

Australian Strategic Services

- About

-

As Chairman of Better Boards and Managing Director of Australian Strategic Services, Michael Goldsworthy’s passion for community businesses (NFPs) cannot be underestimated. For thirty years he has advanced their cause, strengthened their governance and delivered pragmatic solutions; ensuring community businesses remain a vital part of Australian communities and the economy.

Found this article useful or informative?

Join 5,000+ not-for-profit & for-purpose directors receiving the latest insights on governance and leadership.

Receive a free e-book on improving your board decisions when you subscribe.

Unsubscribe anytime. We care about your privacy - read our Privacy Policy .