organisational-development

What Happens When We Don’t Maintain Our Assets?

Published: August 27, 2013

Read Time: 7 minutes

What happens when we don’t maintain our assets? The image that conjures up in my mind is the difference between the shiny new Volkswagen, and the clapped out, exhausted non-maintained lacklustre ‘Herbie’ vehicle we all have grown to love.

The non-profit sector is currently undergoing great change in the requirements of ‘maintenance’ or accountability yet there appears to be such limited resources going toward supporting this change.

Subsequent to the enactment of state based Incorporations Act legislation during the early eighties, which brought about protection and accountability for the members of associations, there has been a steady increase in the reporting and accountability responsibilities for funded projects of the non-profit sector.

I am all for transparency, reporting and accountability, however I believe the gap is widening regarding the expectations of stakeholders and adequacy of resources available to support small-to-medium non-profits to move successfully toward the new regulatory environment. I have a deep understanding and passion for exploring and exposing the complex nature of the sector and the changes that are occurring, I see the issues first hand working at the ‘coal face’ navigating non-profits toward sound financial management practices and compliance.

In 2010 Peter Fitzgerald unveiled eye-opening statistics about the sector in the Productivity Commission’s report “Contribution of the Not-for-Profit Sector”:

- The non-profit sector in Australia is worth at least $70 billion.

- It is Australia’s principal employer with more than 600,000 employees.

- Charities employ about 7% of the workforce and account for 5% of gross domestic product – making the sector equivalent in size to agriculture.

This research also revealed that information about the sector has not been reported to or accumulated in any ‘one’ place, illustrating the complex and fragmented nature of the current regulatory environment.

In my experience small-to-medium non-profit organisations are often governed by committee members who are in a position of responsibility because they are passionate about the outcomes of the service and the community it serves, rather than because they hold a particular academic skill-set. With the rising complexities of accountability and compliance reporting, the sector faces a regulatory risk dilemma. Small-to-medium non-profits are the very fabric of community development, the grass roots that enable resources within the community to meet the needs of the community they serve, and yet they are often not sufficiently resourced to meet their governance responsibilities adequately.

The purpose of my current research provides the opportunity to delve deeper into the complex nature of board activities highlighting the complexities of board dynamics and the way in which board members manage the financial reporting of their entity, providing an insight as to ‘how’ boards are currently engaging in financial management practices and compliance matters and alternate models. Whilst enabling the opportunity to identify if Boards of non-profit organisations are sufficiently engaged with sound financial management practices, to observe Board members confidence in asking questions regarding financial matters, and to determine the level of understanding of financial reports.

Zahara and Pearce (1989)1 have stated,

“There are countless lists of what boards should do. Yet evidence of ‘what boards actually do’ is not well documented… there is a pressing need to document what boards actually do: (pp325 – 326).

Observations to date have revealed that the member of the board responsible for financial matters, usually called the Treasurer, presents a report which is only given moments of ‘air-time’, before the agenda is quickly moved along to matters of general business. The reports that are tabled by the Treasurer are often set out inappropriately, condensing financial data to meaningless reports/spreadsheets, rather than formal financial statements. Evidence shows that there is a lack of interpretation and understanding of accounting standards and formats.

Other observations include the movement away from ‘Community’ based committees/ boards being replaced with ‘Skills’ based board membership which creates the opportunity to bring professional skills to the table, however there is a fear from the membership of losing the ‘community’ focus of their organisation. It has also been revealed that the agenda for board meetings is often set and led by internal staff, with little or no input from the Chair, this has also been noted by Lightbody M (2000)2 as ‘shielding’: creating opportunity to shield information from the board by staff particularly if operations are not going well for the organisation, or if milestones or compliance matters haven’t been met. The committee can be misled by the ‘good news’ stories, and fail to sufficiently address the real issues. Strategic planning, which is the governance role of the board, has been observed to be led by staff, with limited input by board members, often driven by the CEO of the organisation seeking the ‘rubber stamp’ of approval. The CEO’s dominance can be linked to their longevity in holding the position and their qualifications, in contrast with the often-transient nature of board positions. This has also been observed by Renz D (2001)3. The selection of new board members is seen to be led by the CEO or internal staff, creating a feeling of ‘gratitude’ that can impact on the relationship and dynamics of relating as observed through the lens of Ralph Stacey4, and the interplay of human dynamics and the complex nature of relating, with new members having silenced voices.

Two important questions are raised due to the increasing burden of the regulatory environment, coupled with a shrinking pool of funds/resources/volunteers:

- How will government intervention (such as by the Australian Charities and Non-profit Commission) impact the sector’s sustainability? and

- How can boards strengthen their skills and understanding of financial management without losing the value of community-based membership?

Some simple steps that can be put in place to build the capacity of the committee in understanding the financial management of their services could be to:

- Review the current presentation of financial information for the entity

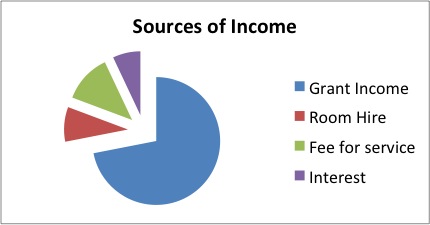

- Review and understand the sources of income received

- Identify any income dependencies that can create risk

- Review the outgoings and expenses

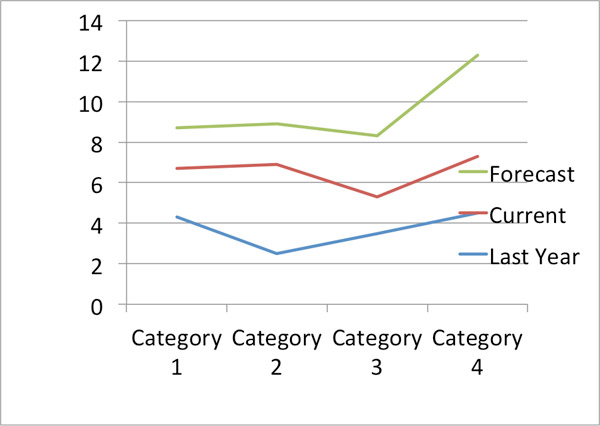

- Identify any critical cost areas that could be monitored over time

- Get clear about what to monitor and which trends to track

- Data analysis for effective decision making

- Uncover what ‘back-story’ the financial reports reveal about your service

- Illustrate this story to other members

- Strengthen/empower the board with informative data to aid in effective decision making

- Create a ‘dashboard’ of key performance indicators

There are a myriad of ways to present financial information to the boardroom to support effective decision making, enabling the interpretation of financial information about the service by those that are perhaps not so financially literate.

- Pie charts

- Trends

- Ratio analysis

- Key critical cost areas – what are we trying to measure / monitor?

- Key critical sources of income

- Are the reports aligned with strategy – what are your services strategic goals this year ?

- Comparison with a budget

The below diagrams are an example of the types of ways in which financial information can be clearly and effectively presented in the boardroom.

The role of governance and the fiduciary responsibilities of the organisation are that of all the committee/board members. This role includes:

- Strategic planning – big picture thinking

- Setting the Vision

- Setting the objectives to meet the key purpose of the organisations existence

- Ensuring sustainability and viability – ability to meet all pecuniary liabilities

- Certify compliance and accountability matters of the organisation are adhered to

So how are your valuable assets being maintained? When we don’t take our vehicles in for a service on a regular basis, we are well aware that we are in for troubled times ahead, and the same could be said for the governance of the non-profit sector. I will leave you with a question: when was the last time you gave your entity a financial management service? This service might involve reviewing the formatting of reports, the type and frequency of financial information you receive, the air-time it is given, the identified skills and talents around the room, and also then being aware of the gaps as a starting point for change.

-

Zahara, S.S & Pearce, J.A., (1989) “Boards of directors and corporate financial performance: A review and integrative model. Journal of Management, 15,291-334. ↩︎

-

Lightbody M., (2000) “Management Reports an Integrated Approach”, Rattler Journal for the Community Child Care Sector Autumn pp19-21. ↩︎

-

Renz,D., (2001) “Changing the Face of Non profit Management” Non profit Management & Leadership, 11(3), Spring 2001 pp387-396. ↩︎

-

Stacey, R. and Griffin, D.,(2005) “Complexity and the Experience of Managing in Public Sector Organisations”. London, Routledge. ↩︎

Share this Article

Recommended Reading

Recommended Viewing

Author

-

Innovation and Performance Partner

- About

-

Adele Johns, was executive officer of Community Compass Inc., working to build the capacity of non-profit organisations in understanding financial management. Adele is highly suited to the sector in both her passion and educational background. Adele has a Bachelor Degree in Commerce from the University of Newcastle and is currently completing a PhD in the area of ‘Governance and Accountability of the non-profit sector’ with University South Australia. Adele has held numerous board and committee positions over the last 30 years, led (non-profit) audit teams in public practice and now having the benefit of 9 years of experience working in the non profit sector at Community Compass Inc guiding organisations to a brighter financial future by equipping treasurers, board members and CEOs in understanding and implementing financial management strategies. Adele currently serves on two non-profit boards, as director of Addsi Home Living Australia and chair of Gosford City charity fund.

Found this article useful or informative?

Join 5,000+ not-for-profit & for-purpose directors receiving the latest insights on governance and leadership.

Receive a free e-book on improving your board decisions when you subscribe.

Unsubscribe anytime. We care about your privacy - read our Privacy Policy .