organisational-development

Preparing a Property Portfolio Business Case

Published: August 19, 2013

Read Time: 3 minutes

There are many reasons why a non-profit organisation may be called upon to undertake a review of their current property needs. This also includes a review of how their property needs are going to be met, both now and into the future.

The type of events that might trigger such a review can be many and varied but generally include:

• A major existing lease expiry or lease renewal option

• A significant operating budget problem arising from occupying old or dysfunctional premises

• A new service offering requiring additional staff and/or client interface

• A new / different service offering requiring additional or alternative delivery space requirements

• Funding restrictions / reductions affecting the service offering or program and highlighting the possibility of a property portfolio reorganisation or rationalisation

Whatever the reason for the review it is very important that the organisation takes a client-centric and people resources focus when assessing its property needs.

As these opportunities for review and renewal occur it is important that they are undertaken with the clear objectives of making improvements in service delivery and staff satisfaction as priority outcomes.

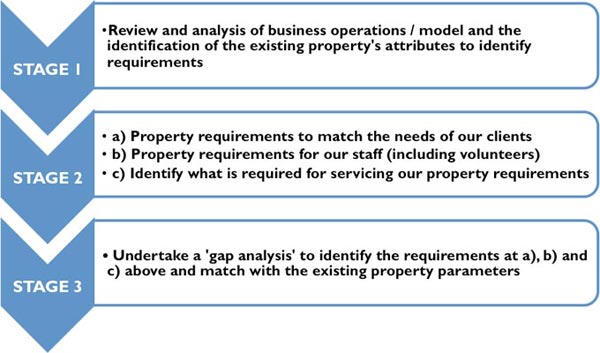

A Property Portfolio Review should follow this process:

The different type of property requirement considerations that are identified at the existing property attributes and at the Gap Analysis stages will include, but are not limited to, the following:

Having identified the specific organisational property needs and existing attributes at Stage 1 and how the existing property or properties fall short of those requirements at Stages 2 and 3, the organisation can then start to prepare the Business Case for ‘closing the gap’.

The first step in the Property Portfolio Business Case is to establish your property requirements and review the gap analysis. The next step is to look at a range of solutions for how that gap can be filled. These are often termed ‘option studies’ with a range of options that might be considered, including:

- The organisation managing the building of a new facility

- Someone else undertaking the building of a new facility with the organisation either buying or leasing it

- Leasing or buying an existing vacant building

- Modifying a building the organisation already owns or leases

- Clearing a site the organisation owns and building something new

- Buying a new site and building something new

- Selling an asset the organisation no longer requires or can vacate (either to raise capital funding for any of the above or simply to raise funds for long term financial security)

Whilst just one or a combination of two or more of the options noted above may eventually be adopted, they should all be tested as options to find the most cost effective solution in the longer term.

Share this Article

Recommended Reading

Recommended Viewing

Author

-

Managing Director

RCP Australia

- About

-

Russell Martoo is the Managing Director of RCP, one of Australia’s largest independent project management consultancies serving the construction and development industries. He is a member of the Australian Institute of Project Management, Australian Institute of Management and a Fellow of the Australian Institute of Building. Following an early career with the Queensland Government Russell joined RCP in 1983 and became managing director in 1987. He has since delivered many developments for clients across a wide range of industries including commercial, retail, residential, health & aged care, public buildings, education, tourism & leisure, industrial, infrastructure and urban renewal projects.

Found this article useful or informative?

Join 5,000+ not-for-profit & for-purpose directors receiving the latest insights on governance and leadership.

Receive a free e-book on improving your board decisions when you subscribe.

Unsubscribe anytime. We care about your privacy - read our Privacy Policy .