finance

Director Financial Literacy

Published: March 10, 2025

Read Time: 8 minutes

As a board director understanding financial statements is not just about fulfilling a role; it’s about proactive stewardship and ensuring your organisation’s success. If the complexity of financial duties seems overwhelming, know that you are not alone. Research from QUT indicates that even seasoned directors regularly engaging with financial statements can feel this pressure (Bettington, 2023).

Director financial literacy is widely defined as ’the ability to read and understand the fundamental financial statements - balance sheet, income statement and statement of cash flows’. In Australia, the legal requirements for director financial literacy are defined through statutes and standards, such as the ACNC Regulation (n 8) s 45.25, also known as Governance Standard 5. This standard mandates that charities registered in Australia take reasonable steps to ensure their responsible persons, including board members, act with reasonable care and diligence, avoid insolvent trading, and manage the charity’s financial affairs responsibly. Landmark legal cases, such as Centro (ASIC v Healey) and the National Safety Council, highlight the severe consequences of failures in financial oversight and reporting (for details see Nel de Koker, 2022; and Ramsay & Webster, 2017). These cases emphasize that reliance solely on experts for financial oversight is inadequate and that directors must understand the financial statements they approve.

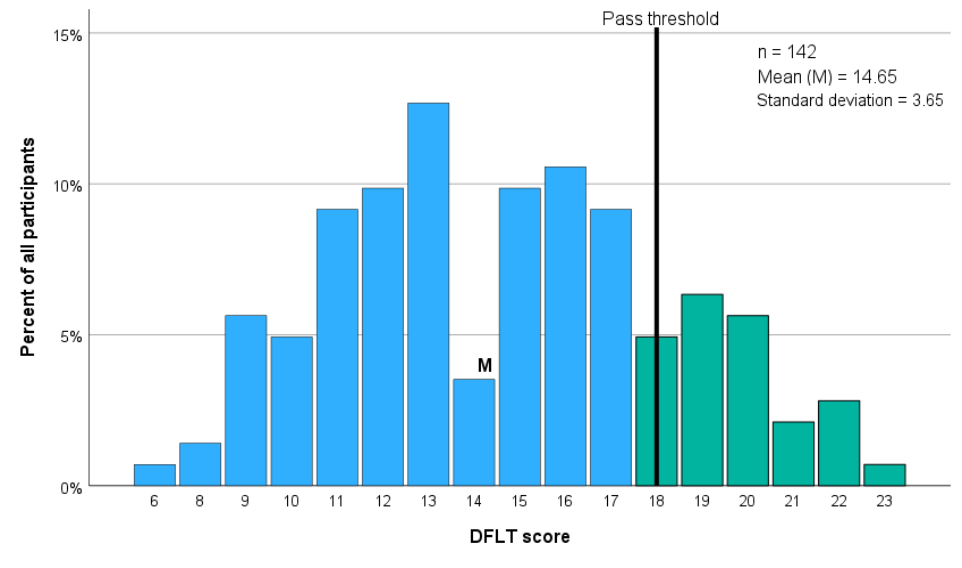

Despite the clear legal framework, identifying directors at risk of breaching their duties has been challenging due to the lack of a reliable and validated test for financial literacy. Recent QUT research has addressed this gap by developing and administering a director financial literacy test and exploring how director financial literacy contributes to nonprofit financial governance (Bettington, 2023). This research tested over 140 board directors across all sectors and found that 78% lacked the minimum legal threshold for ‘director financial literacy’ set by landmark legal cases – Centro and the National Safety Council (Figure 1).

For most directors, lack of confidence in their own financial literacy was a formidable barrier to becoming financially literate. Directors lacking competence and confidence in their financial ability tend to rely on others to monitor the finances: ‘I kind of get a sense or impression. I cannot drill down. I do not have that level of practice with it. But I guess I rely on certainly what others say but more so what I can feel’ (nonprofit director).

This intuitive process in a skills diverse board encourages many directors to rely on ‘a couple of strong players on the team’ - i.e. ‘financial expert colleagues’ (nonprofit board director) which reduces the opportunity and pressure on themselves to develop their own financial literacy and effectively contribute to board financial governance. Thus, it was not surprising to find that 30% of the nonfinancial expert directors participating in the QUT project claimed full reliance on management, a widespread and well-established practice within nonprofit boards (for details see Grant Thornton & Pro Bono Australia, 2015; and Langford & Anderson, 2023).

For individual director’s perspective, this divergence between what the law expects of them and what they do in practice may seem both concerning and daunting to address. The good news is that there is a simple, affordable, and positive pathway for directors to actively develop their financial literacy. The QUT research project found that by adopting the following steps, directors from a variety of backgrounds can evolve into adept financial stewards.

1. Assess Your Current Literacy

Start by scanning this code and taking the QUT director financial literacy test. This will help you identify your strengths and areas for improvement, confirming if you meet the legal standards for financial literacy and guiding your learning efforts more effectively. The test is anonymous, free to use, and the results provided immediately upon submission of your responses.

2. Recognize that training is just the beginning

While training is essential, it merely sets the stage for your financial education journey. To build a solid financial foundation, seek or develop training that covers the strategic fundamentals (financial position, performance, and solvency) and includes practical activities or simulations. If possible, choose a course or workshop that uses your organisation’s financial statements as part of its curriculum. Doing so will not only help you understand the basic financial concepts but also apply this knowledge directly to your organisation, enhancing the practical value and relevance of what you learn.

To further connect learning to practice arrange for the board financial expert or management team to develop a suite of resources explaining the financial statements and reporting process. An efficient and effective way to do this is to develop a glossary, sample statements and series of brief explainer videos of 5 to 15 minutes each. Include videos on each of your organisation’s financial statement and the annual financial reports. This will be a valuable resource for existing and new board directors and allows directors to replay them as needed.

3. Focus on the basics

The familiar adage ‘you need to crawl before you can walk’ applies to the journey towards developing financial literacy for directors. By starting with the basics, non-financial expert directors can effectively fulfil their duties and simultaneously build both competence and confidence in using financial statements. This involves understanding and applying fundamental accounting concepts (e.g. current assets, revenue, and operating activities) to a strategic analysis of the organisation’s financial position, performance, and solvency. Adopting this approach is not only achievable but also crucial in addressing the key oversight areas that have led to notable governance failures in cases like the National Safety Council and Centro.

4. Develop and maintain your own routine for financial monitoring

Establish a routine of regularly reviewing financial statements and stick to it even if you don’t understand everything initially. Directors who lack financial literacy often approach the financial statements as if they were reading a story book - expecting the financial story to begin at the top of the first page and end at the bottom of the last page. Generally, however, the financial story in financial statements, is best accessed by reading across the statements to evaluate specific aspects of that financial story. For example, looking at the cash at the bank line in the balance sheet; moving straight to the cash flow statement to understand the types of activities contributing to the current cash balance; and so on to form a view on the solvency implications.

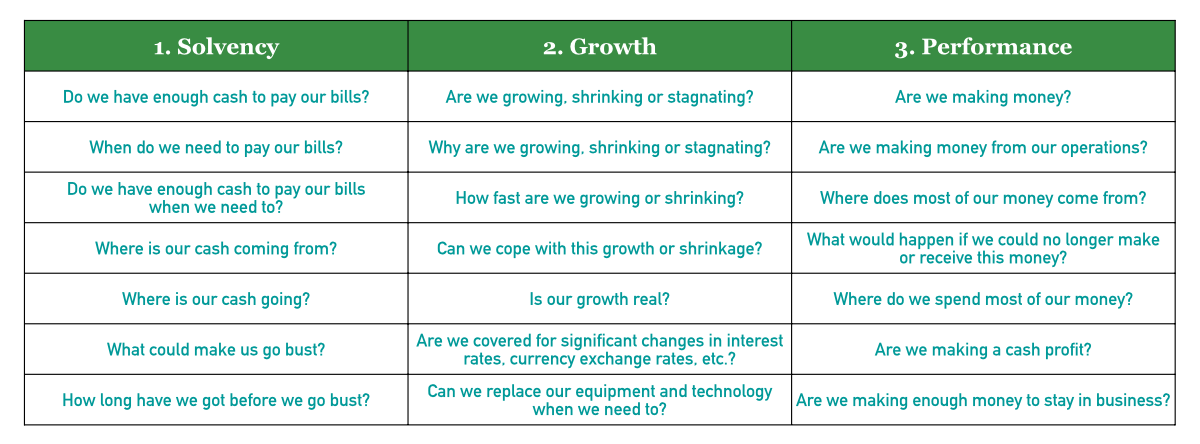

By designing your own structured approach to evaluating the organisation’s strategic financial fundamentals (position, performance, and solvency) you can more efficiently and effectively access the organisation’s financial story in the financial statements. For example, consider customising the questions in Table 1 to suit your board’s context.

5. Encourage and engage in peer learning and support

Whenever you encounter uncertainty regarding a financial term or figure, do not hesitate to ask financial experts and management for clarification. Raising such questions before meetings can help streamline discussions, allowing the board to concentrate on substantive issues during meetings.

Suggest the board establish regular mentoring sessions specifically focused on reading through the financial statements to prepare for board meetings, onboarding new board directors or meeting with auditors. Incorporate mini training workshops to cover specific topics pertinent to the organisation. For example, how grants are dealt with in the financial statements and the implications of different approaches. Working in such an informal setting outside the formal meeting provides a supportive environment for peer learning.

Alternatively, pair less financially literate directors with financial experts or more financially savvy board directors. This mentorship can provide a safe space for learning and discussion. Financial experts on the board can be role models and mentors in financial governance. This approach not only enhances individual director financial literacy but can also strengthen the collaborative dynamics of the board, fostering a culture of ongoing educational growth and mutual support.

With consistent effort and the right resources, you can build the competence and confidence needed to interpret financial information effectively and contribute to informed board decision-making. Embarking on your unique journey towards financial literacy is not just about fulfilling a role; it’s about enhancing your capability to make sound financial judgments and actively participate in board decision-making. In doing so you can make a positive contribution to your organisation’s financial success.

Dr Jackie Bettington, Lecturer & Researcher, Queensland University of Technology For further information about this research and the director financial literacy test, feel free to contact Jackie by email: [email protected]

This article was first published in the 2024 Better Boards Conference Magazine.

References

Bettington, J. (2023). Chapter 11: ‘All for One, One for All, Until…’: Tensions in individual level accountability and board responsibility. In R. T. Langford (Ed.), Governance and Regulation of Charities: International and Comparative Perspectives. Edward Elgar.

Grant Thornton and Pro Bono Australia. (2015). Not for Profits, are you ready for the future?: Findings from our Not for Profit Financial Literacy Survey.

Langford, R. T., & Anderson, M. (2023). Restoring Trust in Charities: Empirical Findings and Recommendations. University of New South Wales Law Journal, 46(2).

Nel de Koker, J. (2022). Regulating volunteer directors’ duties in companies registered with the Australian charities and not-for-profits commission. The University of New South Wales Law Journal, 45(2), 764-797.

Ramsay, I., & Webster, M. (2017). Registered Charities and Governance Standard 5: An Evaluation. Australian Business Law Review, 45(2), 127-158.

Further Resources

Webinar: Director Financial Literacy

Share this Article

Recommended Reading

Recommended Viewing

Author

-

Researcher and lecturer, School of Accountancy, Faculty of Business and Law

Queensland University of Technology

- About

-

Dr Jackie Bettington has over 25 years of experience as a board director, researcher, educator and consultant in the governance, information management and heritage. Her research focus is on understanding how director motivation and capability influence board and organisational performance. Jackie teaches governance, business law, ethics and social enterprise at both undergraduate and post-graduate levels.

Found this article useful or informative?

Join 5,000+ not-for-profit & for-purpose directors receiving the latest insights on governance and leadership.

Receive a free e-book on improving your board decisions when you subscribe.

Unsubscribe anytime. We care about your privacy - read our Privacy Policy .