legal

Navigating NFP Mergers: A Transfer of Business or Control

Published: July 9, 2023

Read Time: 6 minutes

Mergers between not-for-profit (NFP) organisations are becoming increasingly common due to the current challenging economic and regulatory landscape. For some, it can provide an opportunity to better serve communities. For others, it’s the sole option for survival.

Structuring a merger to suit the needs of the organisation is paramount. Merger implementation can have significant consequences for the entities involved, such as tax or funding implications. This article explores what a NFP merger is, the most common options to structure a merger and some tips and tricks to set your merger up for success.

What is a NFP merger?

A NFP merger is when two NFP entities unite to form one NFP entity for the benefit of their members, service users or community. This is sometimes also called an amalgamation.

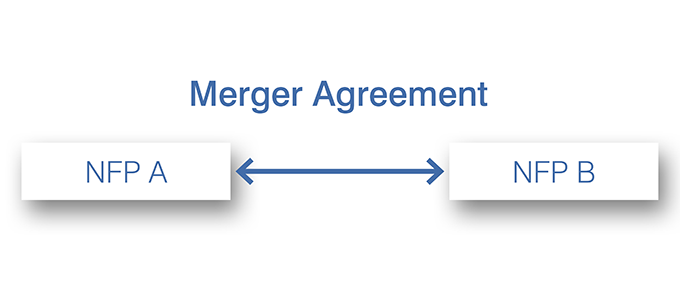

NFP mergers can take various forms. The two most common structures are:

- NFP A assuming or acquiring the business and assets of NFP B, known as a business transfer; or

- NFP A taking control of NFP B, either at the board level or by creating a parent/subsidiary structure.

Whether these options are best for your NFP will depend on a number of factors, including:

- the regulatory landscape;

- the time and resources you have available; and

- the key drivers for pursuing the merger.

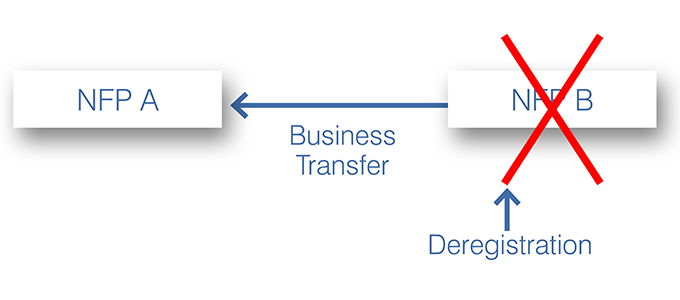

Option 1: Business transfer

Under a business transfer, the business, assets, liabilities and operations of NFP B are rolled into NFP A. NFP A effectively takes over the business of NFP B.

The main advantage of a business transfer is that NFP A can choose to leave certain liabilities with NFP B.

As it will have no or limited assets after the transfer, NFP B will generally wind up or voluntarily de-register shortly after completing the merger.

Some issues you should consider prior to undertaking a business transfer include:

-

whether the members will approve a transfer.

- You should consider whether member approval is required. This may depend on your constitution and establishing legislation. Sometimes, approval is required. Other times, it is advisable as the members always have the power to remove the board if they are not happy with the board’s decision.

-

If the registrations and tax concessions of NFP A and NFP B align.

- If NFP B has registrations that NFP A does not, NFP A will need to obtain those registrations before the transfer takes place.

-

What regulator approvals or processes need to be met.

- This can include departmental approvals, for example aged care transfers.

-

If any funders, financiers or third parties need to approve the transfer.

However, there are some drawbacks, such as the following:

-

A business transfer involves significantly more work and is more time consuming than Option 2. Why? Because more work is required to transfer each element of the business. Merger agreements are required to document the transaction. There are practical aspects, such as employment offers, assignment/novations of existing contracts and leases. A transfer of assets take time.

-

Regulatory setbacks can delay or prevent the transfer taking place, such as registrations not aligning, government approvals not being granted and restrictions on transfer of assets purchased using government funding.

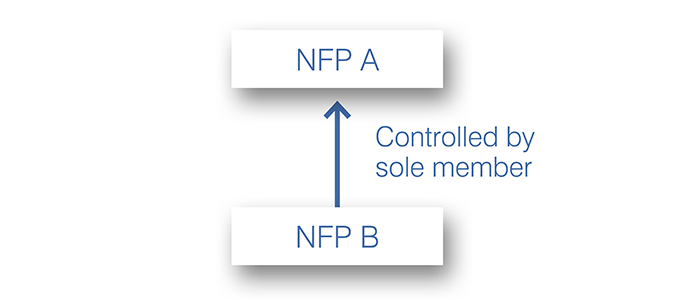

Option 2: Change of control

A change of control maintains the existence of both NFPs by allowing NFP B to continue to operate as a separate legal entity.

This can be done in a couple of ways, either by NFP A taking control of NFP B at the board level or by amending NFP B’s membership so that it becomes a wholly owned subsidiary of NFP A. The result is that NFP A controls NFP B, including its business, assets and operations.

Taking control at the board level can be implemented very quickly. The board of NFP B can resign with persons nominated by NFP A to take their place. However, this might not be a viable long-term structure. It is more complex to have two NFPs, even with group reporting. NFP B might ultimately need its business consolidated with NFP A, by implementing a form of Option 1 at a later date.

Unlike a business transfer, this merger structure usually requires member approval. Member approval can be framed in various ways, such as voluntary resignation of members or by amending the Constitution.

Some issues you should consider prior to undertaking a change of control include:

-

If NFP B’s membership are likely to agree.

- NFP B will likely need to engage in member consultation.

-

If NFP B receives government funding, whether it is required to seek pre-approval or notify the government of a change in control.

-

If any funders, financiers or third parties need to pre-approve the change of control.

Some key advantages to this structure include:

-

It is a much quicker process than a business transfer as it does not require the same level of documentation.

-

NFP B is able to continue its operations without service delivery and staff being disrupted by a business transfer.

-

NFP B can maintain any registrations, regulatory approvals and tax exemptions it receives.

-

Fewer obligations to consult, negotiate and seek government funder approvals e.g. no need to assign or novate any existing funding agreements.

Drawback of this approach

The main drawback to a subsidiary transfer is that the liabilities remain with NFP B despite NFP A having control of its business and operations. The entities will also need to work within any relevant related party regime, such as the one imposed by the Australian Charities and Not-for-profits Commission.

Warning Signs

Prior to undertaking any sort of merger and regardless of which option is right for your organisation, NFPs should consider the following warning signs:

- Inability to articulate a case for merging

- Inability to design a merged board

- Inability to design senior management structure and CEO transitions

- Challenging negotiations

An adversarial approach to any of the above warning signs may be indicative of a poor cultural fit.

Tips for Success

The following tips are essential to ensuring a successful merger, these are:

- Allowing sufficient time to implement the merger regardless of whether you choose a business transfer or change of control e.g. 4-12 months

- Getting advisors involved from the beginning of the process

- Ensuring strong communication between all parties involved

- Pro-actively identify and address problems raised by aggrieved members, staff, board members or the public.

Disclaimer

This article is general commentary. It is not legal advice. If you need specific advice on the topics discussed, please contact the authors. This article must not be reproduced or disseminated without prior written approval from Russell Kennedy.

This article was originally published in the Better Boards Conference Magazine 2023

Further Resources

Get Real: What Are The Questions Boards Need to be Asking During Mergers and Acquisitions?

Developing Deeper and More Strategic Partnerships with Business: A Framework for Moving Forward

Share this Article

Recommended Reading

Recommended Viewing

Author

-

Senior Associate

Russell Kennedy Lawyers

Found this article useful or informative?

Join 5,000+ not-for-profit & for-purpose directors receiving the latest insights on governance and leadership.

Receive a free e-book on improving your board decisions when you subscribe.

Unsubscribe anytime. We care about your privacy - read our Privacy Policy .